January 19th, 2025

Macro Asset Analysis: Navigating a Sea of Uncertainty

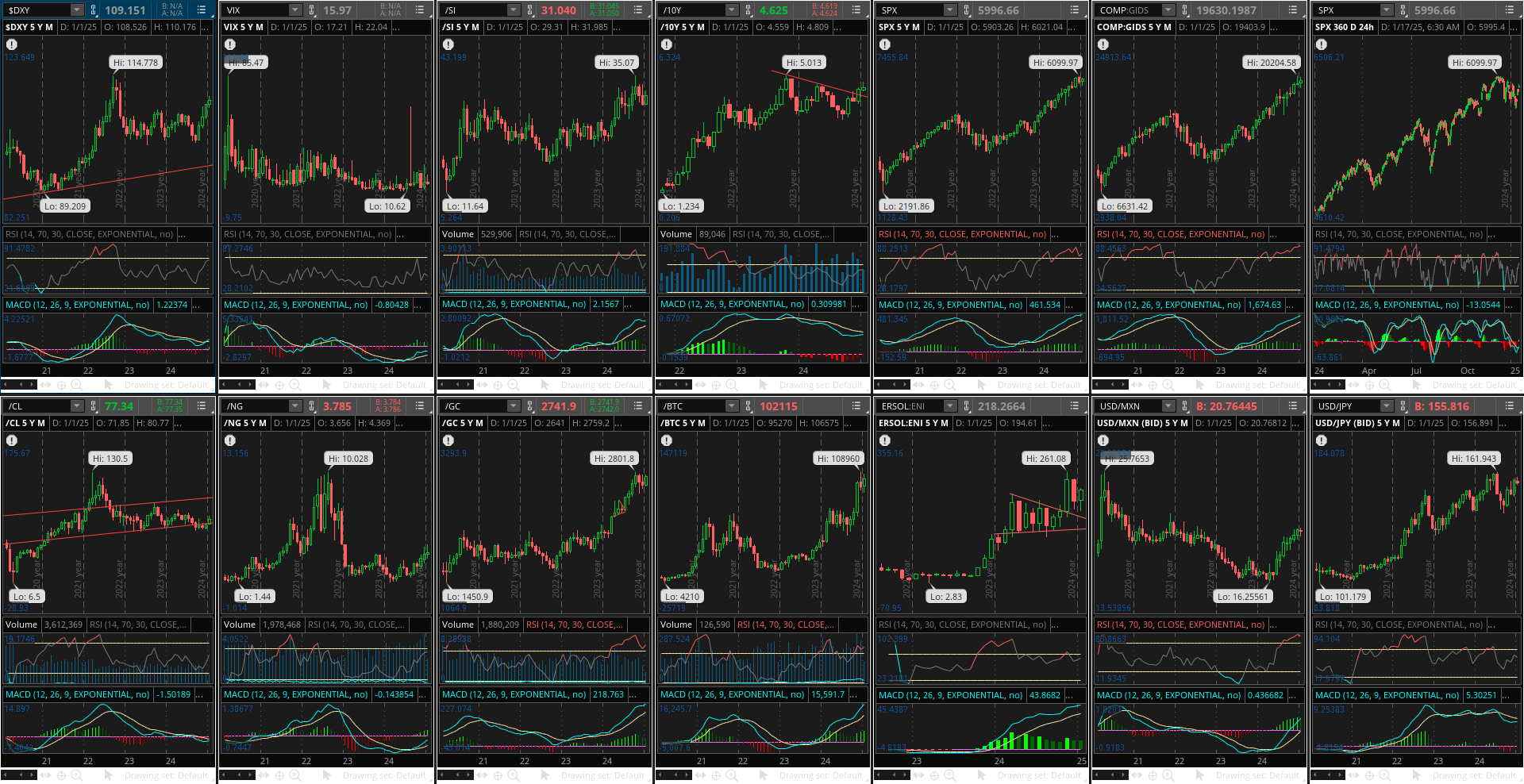

January 19, 2025, has arrived, and the financial markets remain as volatile as ever. Looking at my technical analysis charts, I see a mixed bag of signals across a range of key assets.

Let's dive in:

USD Index (DXY): On the monthly chart, DXY shows a bullish MACD crossover, suggesting potential for further upside. However, zooming in on the weekly chart reveals a picture of potential overbought conditions, hinting at a possible pullback.

10-Year Treasury Yield: The 10-year yield is approaching a bullish MACD crossover on the monthly chart, which could signal rising interest rates.

Commodities: Crude Oil (WTI) appears close to a bullish MACD crossover on the monthly chart. Meanwhile, Natural Gas has already experienced a bullish crossover and has been steadily trending upwards since August 2024.

Equities: The equity markets are sending mixed signals. The weekly chart for the NASDAQ suggests a potential bearish MACD crossover, but it's too early to say if this is a significant reversal.

Cryptocurrencies: Solana initially showed a bearish MACD crossover on the weekly chart, but the launch of $TRUMP has reversed this trend, leading to a bullish crossover.

the strong dollar is a significant concern, and a Plaza Accord-like agreement could be a potential solution in the future. Let's break down the key points:

Why a Strong Dollar is a Concern:

Trade Imbalances: A strong dollar makes US exports more expensive and imports cheaper, leading to trade deficits.

Loss of Competitiveness: US manufacturers and exporters face challenges competing in global markets due to the high cost of their products.

Job Losses: This can lead to job losses in manufacturing and other export-oriented industries.

The Plaza Accord:

History: The Plaza Accord was a 1985 agreement between the US, France, Germany, Japan, and the UK to coordinate currency intervention and depreciate the US dollar.

Success: The agreement was successful in weakening the dollar and reducing US trade deficits.

The Need for a Similar Agreement:

Rising Trade Tensions: The current trade tensions between the US and other countries could lead to further appreciation of the dollar.

Global Imbalances: The US still runs a large trade deficit, and a strong dollar exacerbates this problem.

Limited Policy Options: Traditional monetary policy tools may not be sufficient to address a strong dollar in the current global economic environment.

Potential Challenges:

Coordination: A new Plaza Accord would require coordination among major economies, which can be difficult to achieve.

Market Resistance: Currency markets are highly volatile, and market participants may resist coordinated intervention efforts.

Unintended Consequences: A rapid depreciation of the dollar could lead to inflation and other economic problems.